For a quick update, the following:

- Yes, I am still alive, and back in the States.

- If you haven’t been paying attention to Europe, now’s a good time to grab some popcorn.

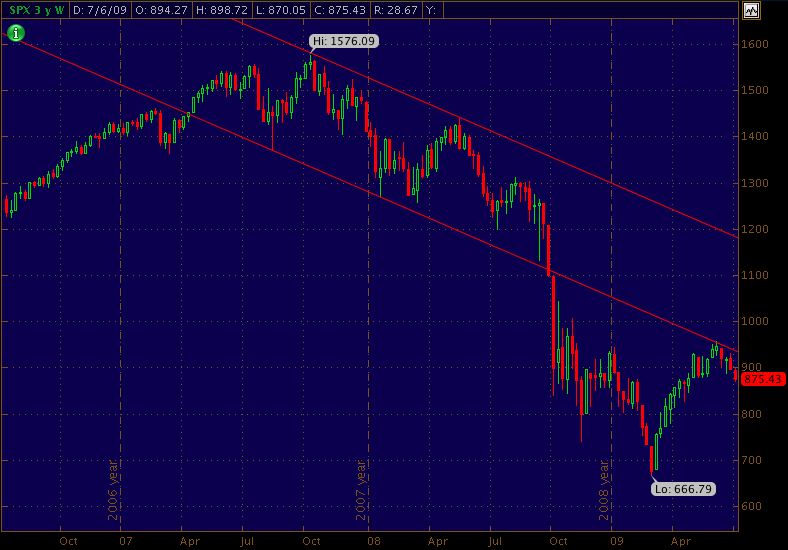

Now for the longer thoughts. For some time (well, since the March 2009 bottom) there had been a general sense on the web that many traditional technical analysis methods weren’t behaving correctly. The market just continued a slow grind upward, mostly due, as Zerohedge put it, to a pair of computers trading shares back and forth to each other. Now, those signals are working again.

There’s also other good news; the civil suit against Goldman Sachs, and a Bloomberg story about Wall Street banks’ massive fleecing of taxpayers in the municipal bond market. The stories aren’t the news; as is usual the details have generally been known for years in advance. The news is that someone in authority seems finally willing to take notice of the problem.

Ob Griechenland über die Zeit wirklich in der Lage ist, diese Leistungskraft aufzubringen, das wage ich zu bezweifeln.

– Deutsche Bank CEO Josef Ackermann, 2010-05-13

As for Europe, most of the resolutions over Greece have been largely hand-waving. As in the U.S., leaders are still preoccupied with blaming speculators and trying to assure investors that everything is perfectly fine. While my earlier expectations of a European “summer of rage” have been delayed, I think the season is now upon us.

In the end, cash flow is what matters. The greatest threat to Greece, and to the rest of the EU, is that promised bailout monies are unable to be had. Accounting standards may be adjusted, GDP can be gamed, but eventually payments must be made. Failed bond auctions, like Spain encountered yesterday, will only add to the pressure.